As part of an ongoing initiative to serve our listeners in the public interest, WNCU 90.7 FM invites you to listen to and participate in a community-based program to discuss joblessness in North Carolina and how it has affected workers in our local communities. On April 28, 2009 from 6:00 p.m. until 7:00 p.m., we will discuss what is at stake for North Carolina workers in a down economy. WNCU 90.7 FM will air a live Town Hall Meeting in the auditorium of the H.M. Mickey Michaux, Jr. School of Education on the campus of North Carolina Central University. This event is free and open to the public. You can also listen live here.

Author ArchiveWNCU 90.7 FM to Hold a Town Hall Meeting on Joblessness in North CarolinaWednesday, April 1st, 2009Frederick “Freddie” Dewayne HubbardWednesday, April 1st, 2009

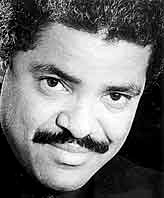

In May 1961, Hubbard played on Olé Coltrane, John Coltrane’s final recording session with Atlantic Records. Together with Eric Dolphy, Hubbard was the only ‘session’ musician who appeared on both Olé and Africa/Brass, Coltrane’s first album with ABC/Impulse! Later, in August 1961, Hubbard made one of his most famous records, Ready for Freddie, which was also his first collaboration with saxophonist Wayne Shorter. Hubbard joined Shorter later in 1961 when he replaced Lee Morgan in Art Blakey’s Jazz Messengers. He played on several Blakey recordings, including Caravan, Ugetsu, Mosaic, and Free For All. Hubbard remained with Blakey until 1966, leaving to form the first of several small groups of his own, which featured, among others, pianist Kenny Barron and drummer Louis Hayes. It was during this time that he began to develop his own sound, distancing himself from the early influences of Clifford Brown and Morgan, and won the Downbeat jazz magazine “New Star” award on trumpet. Throughout the 1960s Hubbard played as a sideman on some of the most important albums from that era, including, Oliver Nelson’s The Blues and the Abstract Truth, Eric Dolphy’s Out to Lunch, Herbie Hancock’s Maiden Voyage, and Wayne Shorter’s Speak No Evil. He recorded extensively for Blue Note Records in the 1960s; eight albums as a bandleader, and twenty-eight as a sideman. Hubbard was described as “the most brilliant trumpeter of a generation of musicians who stand with one foot in ‘tonal’ jazz and the other in the atonal camp”. Though he never fully embraced the free jazz of the ’60s, he appeared on two of its landmark albums, Coleman’s Free Jazz and Coltrane’s Ascension.

Following a long setback of health problems and a serious lip injury in 1992, Hubbard was again playing and recording occasionally, even if not at the high level that he set for himself during his earlier career. His best records ranked with the finest in his field. In 2006, The National Endowment for the Arts honored Hubbard with its highest honor in jazz, the NEA Jazz Masters Award. On December 29, 2008, Hubbard’s hometown newspaper, The Indianapolis Star reported that Hubbard died from complications from a heart attack suffered on November 26 of the same year. Billboard magazine reported that Hubbard died in Sherman Oaks, California. Special Programming on Saturday April 18 for Spring Membership CampaignTuesday, March 31st, 2009We did it once before and you really helped us out during that pledge week. So, back by popular demand, WNCU will offer special programming on Saturday, April 18th for the spring membership campaign. From 9am until noon, we will air specials that give an in depth and historical look at some of your favorite recordings and artists who have made an indelible impact on American music.Celebrating its 50th anniversary, the most popular jazz recording of all time, Kind of Blue, still fascinates even the most experienced jazz listener with its timeless beauty. At 9am, join us for a documentary on the making of Kind of Blue. Miles Davis, Kind of Blue explores the 2 day session in 1959 that changed life for Miles Davis and jazz fans forever. Interviews with Herbie Hancock, Jimmy Cobb, and many others help tell the story of the Kind of Blue sessions. Miles Davis, Kind of Blue will air at 9am. In the late 60’s, the world was introduced to the distinct sound of music originating out of Philadelphia. That’s when Philadelphia International Records landed on the musical map. Love Train, a one hour special, hosted by Jeff Foxx, explores the story of Philadelphia International Records, their impact on soul and r&b music using stories and music from several of their artists, including the contribution of writers Kenny Gamble and Leon Huff. Love Train will air at 10am. At 11am, WNCU will broadcast Sam Cooke: Bring It on Home to Me, a one hour special on the life and music of one of America’s greatest gifts to music, Sam Cooke. This documentary starts with Cooke’s earliest days as a gifted gospel singer and follows his transition to becoming one of the greatest R&B singers of all time. This special will air at 11am. Show your commitment to the music and to the station that brings radio worth listening to every day. If you love Miles Davis, Sam Cooke or Soul from Philadelphia and want to keep it on the air, make your voice heard by calling 919-560-9628. Democracy Now! Tour to Benefit North Carolina Central University’s Radio Station WNCU 90.7 FMMonday, March 30th, 2009

The reception will begin at 6 p.m. Goodman is scheduled to speak at 7 p.m. Goodman describes her book Standing Up to the Madness as “a timely, inspiring, and even revolutionary look at who wields the greatest power in America–everyday people who take a chance and stand up for what they believe in–but also offers advice on what you can do to help”. The award-winning sister-brother team of Amy Goodman, host of Democracy Now!, and investigative journalist David Goodman traveled the country to detail the ways in which grassroots activists have taken politics out of the hands of politicians. Standing Up to the Madness tells the stories of everyday citizens who have challenged the government and prevailed. Democracy Now!, the one-hour daily news program can be heard on WNCU 90.7 FM Monday through Friday at 6 p.m. TO PURCHASE YOUR TICKETS TO SEE AMY GOODMAN CLICK HERE. Click here for ticket information. To check out the Democracy Now! website, click here. Other sponsors include The Peoples Channel, WCOM and Balance and Accuracy in Journalism. Directions to Eno River Unitarian Universalist Fellowship Get directions via Google Maps, by clicking here. Raleigh/Cary (east) Raleigh/Wake Forest Greensboro/Hillsborough National Public Radio’s “Tell Me More” is Coming to WNCU 90.7 FMWednesday, March 18th, 2009

News veteran Michel Martin hosts the show. Martin is an Emmy Award winning journalist and correspondent for ABC News and National Public Radio. She has spent more than 25 years as a journalist — first in print with major newspapers and then in television. Martin came to NPR in January 2006 to develop Tell Me More. Tell Me More regularly features a group of mothers known as the Mocha Moms who talk about everything from relationships to politics, and a “Barbershop” segment in which a mostly black cast of men hashes out topical issues. Tell Me More, the one-hour daily NPR news and talk show, can be heard on public radio stations around the country. The show aims to reach out to African Americans, Hispanics and others who are underrepresented in NPR’s audience. The show airs on WNCU 90.7 FM Monday through Friday at 5:00 p.m. Phil UpchurchTuesday, March 3rd, 2009

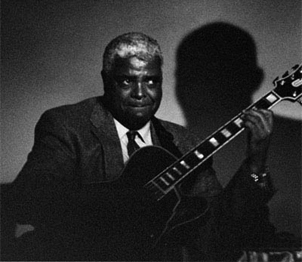

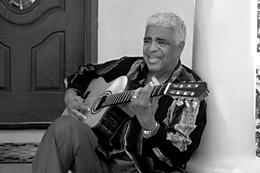

Upchurch later appeared on albums by Bo Diddley, Muddy Waters, Jimmy Reed and Howlin’ Wolf. He frequently teamed with drummer Maurice White, who later headed Earth, Wind and Fire. In the 1970s Upchurch appeared on several fusion albums, including Grover Washington, George Benson and The Crusaders. One album in particular is George Benson’s 1976 album, Breezin’. Phil Upchurch plays the rhythm guitar, except for “Breezin'” and “Six to Four” where he plays bass. In the 1980s he appeared on Marlena Shaw’s “Could It Be You.” He has also collaborated with Chaka Khan, Booker T. Jones, Leroy Hutson and Michael Jackson.

He remains active as a session musician and bandleader, returning in 1999 with Rhapsody and Blues. Tell the Truth appeared in spring 2001. Upchurch received a Pioneer Award from the Rhythm and Blues Foundation in 1997. WNCU 90.7 FM Presents “Tax Tips with Professor Reginald Mombrun”Monday, February 23rd, 2009

With tax season under way, WNCU 90.7 FM is making tax information available to listeners free of charge. WNCU is collaborating with North Carolina Central University’s School of Law to present, Tax Tips with Professor Reginald Mombrun. NCCU Professor Mombrun and freelance producer Marquita McAlpine, host the show. Tax Tips with Professor Reginald Mombrun, helps taxpayers better understand the tax filing process. According to Professor Mombrun , “The tax tips are important because people may not be aware of the tax benefits that they are allowed under the law. Students, parents and the public in general will benefit from these tips.” “Professor Mombrun provided the tax expertise and WNCU provided the platform to air 10 short vignettes that we hope will help people with their tax preparation”, said McAlpine. As a producer and a student, I found this information interesting and helpful. Young people are becoming more independent with their finances. The information provided through the tax tips will improve students’ knowledge when filing taxes. Taxpayers can listen to the vignettes heard daily on WNCU for valuable tax information. Professor Mombrun has been responsible for a number of regulations, revenue rulings, revenue procedures and countless private letter rulings in the corporate tax area. He joined the school of law in the fall of 2008. Previously he taught at Florida A&M’s College of Law from the fall of 2004 to the summer of 2008. Professor Mombrun spent 14 years in the national office of the IRS specializing in corporate mergers and acquisitions. He also served as an assistant branch chief his last two years at the IRS. Professor Mombrun states, “Working at the IRS was a very rigorous intellectual environment. I was writing regulations that impacted the whole nation. So I was under pressure to get it “right.” To further help people with their tax preparation this year Mombrun suggests that people take advantage of free tax assistance program through NCCU’s Law School. Tax filers who earned less than $39,000 ($41,600 for families) can have their tax returns prepared at NCCU’s Law School through the government approved Volunteer Income Tax Assistance (VITA) program. This service is offered to members of the community as well as to NCCU students and employees. NCCU Law student volunteers trained and certified to prepare basic tax returns will prepare, print and file federal and North Carolina income tax returns on Saturdays from 9:00 a.m. until 3:00 p.m. and Wednesdays from 6:00 p.m. until 8:00 p.m. The NCCU VITA Site is located in the Law School building, 2nd floor Computer Lab. Taxpayers wishing to have their returns prepared by VITA should bring them:

For a full listing of locations and hours of other VITA sites in the Durham area, please visit www.cra-nc.org. The complete scripts of the vignettes are listed below. Please click the topic of the script which you are interested in reading. Topic 1: Stimulus Recovery Credit The complete scripts of the vignettes are listed below. Topic 1: Stimulus Recovery CreditMarquita: Prof. Mombrun, I understand that taxpayers can still get money from the IRS in the form of a rebate check. Prof. Mombrun: Yes, Marquita, this is true for some taxpayers but not all taxpayers. To get the credit, you must meet the following requirements: One, you must have a valid social security and everyone you are claiming the credit must also have a valid social security. Second, if you received all your stimulus payments last year, you cannot get any more money ($600 for single and other taxpayers and $1,200 if you filed a joint return. Third, the same restrictions as last year apply, meaning that if you have income more than $75,000 ($150,000 if joint, you will get less money). Fourth, and that’s a big one: (i) if you received a stimulus check of at least $300, your tax due for 2008 is $300, your filing status did not change from last year and you do not have any qualifying children, you do not qualify for the credit. There are other restrictions that may apply in your case as well. The bottom line is that you may still get some of that recovery rebate money. It’s something that the government is doing because this is supposed to be good for the economy. Finally, If you are filing a form 1040EZ, pay attention to line 9, if you are filing a form 1040A, pay attention to line 42 and if you are filing the long form 1040, pay attention to line 70. Once you are on the line, follow the instructions very very very carefully. If you do not want to follow the instructions, just write the letters RRC (recovery rebate credit) on the appropriate lines. If you are eligible to get money, the IRS will send it to you. If you do not trust the IRS, then figure out the credit yourself. Topic 2: First Time Homebuyer CreditMarquita: Prof. Mombrun, a friend of mine is interested in buying her first home but she does not have a lot of money, someone told her that the federal government can help with a tax credit, is that true? Prof. Mombrun: This is indeed true and this is good news for first time homebuyers. People should think of the first time homebuyer credit as an interest free loan because it has to be repaid to the government. The good news is that you can take up to 15 years to repay the loan to the government. You repay it by including $500 in additional tax in each of the following years after you take the credit. If you want to take the credit, you must file the long form (Form 1040). There are some restrictions on the credit. First your home must be bought after April 8, 2008 and before July 1, 2009. So if you have not bought a home yet and you want to get the benefit of the credit, hurry up. It also applies if you build a home and can be used for a house, houseboat, condominium or other type of residence. The key is that it should be your main place of residence, where you spend most of your time. The other thing you must know is that this is not a complete giveaway and not everybody can qualify. For example, if your modified income is $95,000 or more ($170,000 if you are married filing jointly) you cannot take the credit. If your modified income is more than $75,000 ($150,000 if married filing jointly), your credit will be reduced. If you take the first-time homebuyer in the District of Columbia, if you are a non-resident alien, if your home is located outside the United States, if your home is purchased using tax-exempt bonds. If you sell your home or it ceases to be your main home by the end of 2008, you cannot claim the credit, if the home was given to you or you acquired from somebody you are close to like a relative or a corporation or partnership that you control. Finally, if you sell your home after 2008, you will have to repay up to the amount of your gain on the sale. For example, if you purchased a home in 2009 (before July 1, 2009) and you sell it in 2011, you would have repaid $500 to the government and you would have owed the government $7,000. If you gain on the sale is $6,000, you only have to repay the government $6,000. If your home is destroyed or condemned and you purchase a new home within two years, you can continue with your scheduled $500 payment. If the home is transferred to your former spouse in a divorce settlement, they have to make the payment, not you. Finally, if you die, you (or your estate) no longer owe the government any money. Topic 3: The Earned Income Tax CreditMarquita: Prof. Mombrun, what is the earned income tax credit, what is it about? Prof. Mombrun: Good questions! The earned income tax credit has been around for a while now. It is designed to help people who are working, have income but need a little help to make ends meet. It rewards you for working. Marquita: How do you qualify for the earned income tax credit? Prof. Mombrun: There are many rules that you must follow. They are not as bad as people think. But if you need help, you can come to our volunteer income tax site for help. We will help you figure it out and also file your taxes for you online for free. Here are the rules for the earned income tax credit: First, your income level must not exceed a certain amount. If you have more than one qualifying child (two or more) your income has to be less than $38,646 or $41,646 if you are married and file a joint return. If you only have one qualifying child, the income level must be $33,995 or $36,995 if you are married filing a joint return. If you do not have a qualifying child, the income level is $12,880 or $15,880 if you are married and filing a joint return. So this really helps you if you have children. Now, what is a qualifying child? It can be a son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister, niece, nephew but the person has to be under the age of 19 at the end of 2008 or under the age of 24 if the person is a student. If the person you are claiming is permanently and totally disabled, you can claim him or her regardless of age, he or she can be more than 24 years old. Marquita: Is that all? Prof. Mombrun: There are other restrictions such as you must have a valid social security car, you must be a U.S. citizen or permanent resident, you must have earned income during the year, income from your investment such as a bank account, a CD may not be more than $2,950. The government figures if you are getting more than that in investment income, you must be doing OK. Also, if you have income from a foreign country, you will not qualify for the earned income credit. There are also special rules that apply if you have a qualifying child: The child cannot be used by more than one person to claim the EIC and if you are claiming the earned income tax credit, you cannot be the qualifying child of another person. If you do not have a qualifying child, you must be at least 25 years of age to claim the credit but no more than 65, you cannot be the dependent or qualifying child of another person and you must have lived in the country for more than half of the year. Last thing, I want to say is that you can figure out the credit yourself, you or the person who does your taxes or you can have the IRS figure it out for you. If you want the IRS figure out your credit for you, just do the following: if you file form 1040, just write down the letters EIC on line 64c—write the letters on the dotted lines. If you file form 1040A, the shorter form, just write EIC on the left of line 40a and if you file a form 1040EZ, just write the letters EIC on the left of line 8a. Topic 4: Standard Deductions for 2008Marquita: Prof. Mombrun, I’ve heard that the standard deduction for 2008 is higher than last year and that now you can deduct your real estate taxes as part of your standard deduction. Prof. Mombrun: Yes, Marquita, this is an exciting thing for homeowners who do not itemize. Here is how it works; the homeowner can add an additional $500 or $1,000 (if this is a married couple filing a joint return) to their standard deduction. The only other way you can deduct your real estate taxes is if you itemize your deductions. If you are going to use the additional standard deduction, you cannot use the form 1040EZ; you have to use form 1040A or 1040. If you use form 1040A, check the box on line 23c, if you are using form 1040, check the box on line 39c Marquita: When should taxpayers itemize? Prof. Mombrun: Taxpayers should itemize instead of taking the standard deduction when their itemized deductions exceed their standard deduction. This normally happens when a taxpayer has a large medical and dental expenses for the year, paid lots of mortgage interests and real estate taxes, had large uninsured casualty or theft losses—when your itemized deductions exceed your standard deduction. Keep in mind that your standard deduction for 2008 is $5,450 if you are single, $10,900 if you are married filing jointly or a qualifying widow or widower and $8,000 if you are a head of household. In addition, you get a higher amount if you are blind or age 65 or older. The two things you should remember for 2008 is that you can deduct up to $500 ($1,000 if filing a joint return) in real estate taxes as a standard deduction and any losses you incurred if you suffered a loss in a federally declared disaster area. Last, you should also remember that you can get up to $900 in standard deduction if someone claims you as a dependent. This means if you are a student, you have a job in which you pay federal income taxes and your parent claims you as a dependent, you should still file to get your money back. Topic 5: The Hope ScholarshipMarquita: Prof. Mombrun, tell me about some of the tax benefits for students. Prof. Mombrun: Sure! There are several credits that students can qualify for, let’s talk about the Hope Scholarship Credit. First, a credit is a very good thing because it reduces your taxes more, a deduction is good also but a credit is better. If you can get a credit, get it. The Hope scholarship credit amount for 2008 is up to $1,800. If your parents claim you as a dependent, they can get the credit but they or you (or somebody) must have incurred some expenses for your education. So if you are on a full scholarship and you pay nothing for your education, you cannot get the credit. If you have student loans or you use money from a part-time job, or money that was given to you or left to you in a will, if you or your parents pay for your education, you can qualify for the Hope credit. The Hope Scholarship only applies for the first two years of college (Freshman and sophomore), after that—it’s gone. Plus to get the full benefit of the credit, your expenses must be $2,400 and you must be enrolled at least ½ time. What kind of expenses will qualify for the credit? Tuition, fees and related expenses such as books, supplies, and equipment needed for your courses. Room and board? No! Transportation, medical insurance, any sort of personal expenses do not count. Also, if you (or your parents or whomever) are claiming the credit–the person cannot file as married filing separately, the person cannot be a dependent, the person’s modified gross income cannot be more than $58,000 ($116,000 if married filing jointly), the person cannot be a nonresident alien or the person cannot be claiming the tuition and fees deduction. You cannot get both; you can only get one or the other. The bottom line is that if you or your parents paid money for you to got to school even if it is a loan, they (or you) might be able to get $1,800 in credit under the Hope scholarship if you are in your first two years of college and they (or you) spend $2,400 in tuition or fees. If you or your parents spend less than $2,400 in college costs, you can still get a Hope Scholarship Credit but it will be less than $1,800. To see if you qualify for the Hope Scholarship Credit, get a copy of Form 8863, follow the form very carefully and you will be able to figure out your credit. Good Luck! Topic 6: The Lifetime Learning CreditMarquita: Prof. Mombrun, you gave me some valuable information about the Hope scholarship but you said it only applies if I am a freshman or sophomore. Well, I am a junior; does that mean I can’t get any credit? Prof. Mombrun: No! You will not qualify for the Hope scholarship credit but you can always get the lifetime learning credit. There are good things and bad things about this credit when you compare with the Hope scholarship. First, the similarities—you cannot take the lifetime credit if your filing status is married filing separately, you (or the person trying to take the credit) are listed as a dependent, you (or the person trying to take the credit) are a nonresident alien, you claim tuition and fees deduction for the year, or your modified gross income is $58,000 (or $116,000) if filing a joint return and you or whomever claim the credit cannot be a nonresident alien. Second, you must incur expenses paid by you or somebody else; it can be from loans, a job etc… Just like the Hope credit, it cannot be from scholarship money or any money that you do not have to repay. What kind of expenses? Not all kinds, it has to be for tuition and related expenses such as books, supplies, equipment needed for your courses. Cost of food or dorm room? No, these do not count. Transportation, medical insurance, any sort of personal expenses do not count. Now for the big differences! The lifetime credit is forever, you can take it until you die. You do not have to be in school ½ time. You can be taking one course or 10 courses. The amount of the lifetime credit is up to $2,000 but you would have to spend up to $10,000 to get that $2,000 credit. To get $1,800 in credit like the Hope credit, you would have to spend about $9,000 to get that $1,800 credit. An interesting little known fact about the Hope scholarship is that if you are convicted of a drug felony offense, you do not qualify for the Hope scholarship but you would still qualify for the Lifetime learning credits. The bottom line is that if you are in school and you (or a parent or somebody) are paying money for tuition and fees, you might be eligible for the Lifetime learning credit. To see if you qualify for the Hope Scholarship Credit, get a copy of Form 8863, follow the form very carefully and you will be able to figure out your credit. Good Luck! Topic 7: Deduction for student loan interestMarquita: Prof. Mombrun, we’ve talked about the Hope Scholarship Credit and the Lifetime Learning Credit, are there any other tax deductions for students? Prof. Mombrun: Yes, you might be able to get a deduction for interest paid on your student loans. With the kind of loan amounts these days, the interest payments may be hefty. If you or your parents paid interest on your student loans, you or your parents may be able to claim up to $2,500 in interest deduction. If you pay less than $2,500 (say $1,000) you will be able to deduct only $1,000. The student loan or loans must have been taken to pay tuition, fees and related expenses such as books, supplies and equipment but you can also include room and board and other necessary expenses such as transportation. This helps because normally you are not allowed to use expenses for room and board in getting a tax credit. A few things you have to remember: this deduction only applies if you are enrolled at least half time in school, you cannot take it if your modified gross income is $70,000 or more or $145,000 (if you are filing a joint return), If your income is less, then you should be OK. Also if your filing status is married filing separately, you cannot get the deduction—no matter what your income is; You also cannot take the deduction if the loan that you are paying interest on is from a person that you are related to such as your spouse, a brother/sister or half brother/sister, or parents, grandparents, even a corporation or partnership to which you are related. Finally, if you are claiming a deduction for interest you paid on your student loans, you cannot use the Form 1040 EZ; you have to us either Form 1040A or the long form 1040. If you are using the long form 1040, pay attention to line 33 and if you are using Form 1040A, pay attention to line 18. Topic 8: Deduction for tuition and feesMarquita: Prof. Mombrun, a business student told me that if you do not qualify for the Hope Scholarship Credit or the Lifetime Learning Credit that you might still be able to take a deduction for tuition and fees paid for school, is that true? Prof. Mombrun: Yes, Marquita, this is true. But, I must give you a warning, the Hope Scholarship Credit, the Lifetime Learning Credit and the tuition and fees deduction are not cumulative, this means that cannot take them all together, you can only take one or the other. For example, if you take the Hope Scholarship Credit, you cannot take the Lifetime Learning Credit or the education expenses deduction and vice versa. What these things give you is flexibility. You can see which ones you can qualify for and which ones give you more money back and take that one. For the tuition and fees deduction, the expenses have to be qualified tuition and related expenses such as fees, books, supplies etc… They cannot be room and board or any kind of personal expenses. You can also use any source that you use to pay your school expenses such as loans, gifts, part-time jobs, savings etc… but you cannot use any educational assistance that you do not have to repay, such as a scholarship (if it is tax-free) or Pell grants. Let’s do a quick example so we can see how you can claim. Let’s say your family gives you $2,000 in 2008 to help you out, you took out a loan for $10,000 and you make $2,000 from a part-time job to cover your total expenses of $14,000, of that amount only the tuition and related fees will be deductible—for example if room and board and other personal expenses total $5,000, you can only deduct $9,000. If you have been in school for three years, you will not be able to take the Hope Scholarship Credit but you might be able to take the tuition and fees deduction. A few other things you must keep in mind: One, the deduction is not available if you or the person claiming the deduction files their tax return as married filing separately, the person is a non-resident alien, the person’s modified gross income is $80,000 (or $160,000 if married filing jointly) or again you claim the Hope Scholarship or Lifetime Learning Credits. Finally, if you are thinking about claiming the tuition and fees deduction, you cannot use Form 1040 EZ; you have to use either Form 1040A or Form 1040. Topic 9: Filing Status? Single? Married filing Separately or Married filing jointlyMarquita: A friend of mine just got divorced from her husband; they have no kids, should she file as a single person, married filing separately or married filing jointly? Prof. Mombrun: What year was the divorce final? 2008 or 2009? Marquita: I think 2009, because she called me last week and told me she just got her final divorce papers from the court? Prof. Mombrun: OK, let’s say the divorce was final this year 2009. This means that she was married during the whole year 2008. She cannot file as a single person because to file as a single person, you must be unmarried or legally separated from your spouse under a divorce or separate maintenance decree (something the court gives you) and you do not qualify for any other filing status. It sounds like she did not have any of these, this means she would be considered married at the end of 2008. Her choices are either Married filing separately, married filing jointly or Head of household is she had a child living with her or some other relative that she can claim as a qualifying relative. If she does not qualify for Head of household, then her choices are limited to married filing separately or married filing jointly. I very rarely recommend that somebody choose married filing separately because this generally means that your taxes are higher and lots of credits that you would otherwise have qualified for disappear such as the child and dependent care expenses credit, the earned income credit, any of the education credits such as the Hope Scholarship credit, the lifetime learning credit or the tuition and fees deduction, the list goes on. But in her case, she may not be able to get her ex-husband to sign the return or she may not want to be liable for his taxes now that they are no longer married because filing a joint return means that both husband and wife are responsible for any taxes owed on the return. Again, I normally recommend that couples file a joint return. Even if your spouse dies during the year, you will still be eligible to file one last joint return with your deceased spouse. There are other situations that you can file a joint return even if your spouse cannot sign for example if your spouse is in the armed forces and in a combat zone such as Iraq, Afghanistan. Topic 10: Who can claim you as a dependent?Marquita: Prof. Mombrun, my parents want to claim me as a dependent even though I only go home for a few weeks during the summer and spend most of time in school, will they get in trouble for that? Prof. Mombrun: Not necessarily. Your parents can still claim you as a dependent even when you are away from school if they meet the following tests:

The relationship test means that you have to be a son, in your case daughter, but you could have also been a stepchild, foster child, grandchild, brother, sister, half brother, nephew, niece—really what we would call a close relative The age test means that you have to be less than 19 at the end of the year or if you are a full-time student, less than 24 at the end of the year. If the child or close relative is permanently and totally disabled at any time during the year, then age will not matter. The residency test means that the qualifying child must have lived more than half the year with the parents, (6 months plus one day). There are exceptions, for example if the child was in school, like you or in the military, in the hospital or away on business. The support test means that the parents must have provided more than half of the support of the child. If it takes about $10,000 to support the child for the year, this means that the parents must have provided $5,001 of that support Finally, there are special tests to determine who wins and get the deduction if more than one person can claim the child as a dependent. If the claim is between a parent and someone who is not a parent, for example, your aunt helps you out and wants to claim you but your father helps you out too—your father will win. If two parents are divorced, the deduction goes to the parent with whom the child lives the most. If the child lives exactly the same amount with each parent, then it goes to the parent who makes the most money. Black History Month – Music PodcastsSaturday, February 21st, 2009The Legacy Podcast features Miles Davis, Sam Cooke, Fats Waller, Buddy Guy, Ashford & Simpson and more great musicians in their Black History Month podcast series!

Passing of Louie BellsonTuesday, February 17th, 2009We regret to announce the unexpected passing of Louie Bellson on Feb 14, 2009. Tentative plans are for an Los Angeles area funeral, followed by funeral and burial in Moline, Illinois, his childhood home. Details forthcoming. Condolences and cards to: Contributions in memory of Louie Bellson can be made to: Click here to view him performing with Duke Ellington. 2009 Black History Month SpecialsWednesday, January 28th, 2009Friday evenings from 9pm-10pm in February. February 6Jazz Profiles – Al Hibbler: Unchained Melodist: Jazz Profiles from NPR February 13Paris Noir: Part of the Night Lights Classic Jazz series In the years following World War II, a number of African-American jazz musicians took up residence in France, inspired by the relative lack of racism, the working opportunities, and the appreciation that French audiences showed for their art. Jazz greats such as Dexter Gordon, Bud Powell, Kenny Clarke, and Don Byas spent long periods of time on the European continent and made many recordings there; we’ll hear from them as well as trumpeter Bill Coleman, tenor saxophonist Lucky Thompson, avant-garde group the Art Ensemble of Chicago, and more. February 20Jazz Profiles – Milt Hinton: The Ultimate Timekeeper: Jazz Profiles from NPR February 27Lady Writes the Blues: The Rose Marie McCoy Story Featuring interviews with performers Maxine Brown, Aretha Franklin, Jimmy Scott, Rose Marie McCoy, along with previously unreleased songs and a rare recording of McCoy performing in her final concert at the age of 86. |

Frederick Dewayne Hubbard was born April 7, 1938 and died December 29, 2008. He was an American jazz trumpeter and was known primarily for playing in the bebop, hard bop and post bop styles from the early 60s and on. His unmistakable and influential tone contributed to new perspectives for modern jazz and bebop. Hubbard started playing the mellophone and trumpet in his school band, studying at the Jordan Conservatory with the principal trumpeter of the Indianapolis Symphony Orchestra. In his teens, Hubbard worked locally with brothers Wes and Monk Montgomery and with bassist Larry Ridley and saxophonist James Spaulding. In 1958, at the age of 22, he moved to New York, and began playing with some of the best jazz players of the era, including Philly Joe Jones, Sonny Rollins, Slide Hampton, Eric Dolphy, J. J. Johnson, and Quincy Jones. In June 1960, Hubbard made his first record as a leader, Open Sesame, with saxophonist Tina Brooks, pianist McCoy Tyner, bassist Sam Jones, and drummer Clifford Jarvis. In December 1960, Hubbard was invited to play on Ornette Coleman’s Free Jazz after Coleman had heard him playing with Don Cherry.

Frederick Dewayne Hubbard was born April 7, 1938 and died December 29, 2008. He was an American jazz trumpeter and was known primarily for playing in the bebop, hard bop and post bop styles from the early 60s and on. His unmistakable and influential tone contributed to new perspectives for modern jazz and bebop. Hubbard started playing the mellophone and trumpet in his school band, studying at the Jordan Conservatory with the principal trumpeter of the Indianapolis Symphony Orchestra. In his teens, Hubbard worked locally with brothers Wes and Monk Montgomery and with bassist Larry Ridley and saxophonist James Spaulding. In 1958, at the age of 22, he moved to New York, and began playing with some of the best jazz players of the era, including Philly Joe Jones, Sonny Rollins, Slide Hampton, Eric Dolphy, J. J. Johnson, and Quincy Jones. In June 1960, Hubbard made his first record as a leader, Open Sesame, with saxophonist Tina Brooks, pianist McCoy Tyner, bassist Sam Jones, and drummer Clifford Jarvis. In December 1960, Hubbard was invited to play on Ornette Coleman’s Free Jazz after Coleman had heard him playing with Don Cherry.

Hubbard achieved his greatest popular success in the 1970s with a series of albums for Creed Taylor and his record label CTI Records, overshadowing Stanley Turrentine, Hubert Laws, and George Benson. Although his early 1970s jazz albums Red Clay, First Light, Straight Life, and Sky Dive were particularly well received and considered among his best work, the albums he recorded later in the decade were attacked by critics for their commercialism. First Light won a 1972 Grammy Award and included pianists Herbie Hancock and Richard Wyands, guitarists Eric Gale and George Benson, bassist Ron Carter, drummer Jack DeJohnette, and percussionist Airto Moreira. In 1994, Freddie, collaborating with Chicago jazz vocalist/co-writer Catherine Whitney, had lyrics set to the music of First Light.

Hubbard achieved his greatest popular success in the 1970s with a series of albums for Creed Taylor and his record label CTI Records, overshadowing Stanley Turrentine, Hubert Laws, and George Benson. Although his early 1970s jazz albums Red Clay, First Light, Straight Life, and Sky Dive were particularly well received and considered among his best work, the albums he recorded later in the decade were attacked by critics for their commercialism. First Light won a 1972 Grammy Award and included pianists Herbie Hancock and Richard Wyands, guitarists Eric Gale and George Benson, bassist Ron Carter, drummer Jack DeJohnette, and percussionist Airto Moreira. In 1994, Freddie, collaborating with Chicago jazz vocalist/co-writer Catherine Whitney, had lyrics set to the music of First Light. North Carolina Central University is pleased to announce that award-winning journalist Amy Goodman, host of the daily, grassroots, global, radio/TV news hour Democracy Now!, is on a national speaking tour to mark DN!’s 13th anniversary and launch her third book with journalist David Goodman, Standing Up to the Madness: Ordinary Heroes in Extraordinary Times.While on tour, Goodman is scheduled to appear at the Eno River Unitarian Universalist Fellowship at 4907 Garrett Road in Durham, NC on Wednesday, April 8, 2009. WNCU 90.7 is a media sponsor of this event. Proceeds from the reception and lecture ticket sales go directly toward continued operation of WNCU. This event is open to the public. For ticket information, please contact WNCU at (919) 530-7445 Monday through Friday 8 a.m. to 5 p.m.

North Carolina Central University is pleased to announce that award-winning journalist Amy Goodman, host of the daily, grassroots, global, radio/TV news hour Democracy Now!, is on a national speaking tour to mark DN!’s 13th anniversary and launch her third book with journalist David Goodman, Standing Up to the Madness: Ordinary Heroes in Extraordinary Times.While on tour, Goodman is scheduled to appear at the Eno River Unitarian Universalist Fellowship at 4907 Garrett Road in Durham, NC on Wednesday, April 8, 2009. WNCU 90.7 is a media sponsor of this event. Proceeds from the reception and lecture ticket sales go directly toward continued operation of WNCU. This event is open to the public. For ticket information, please contact WNCU at (919) 530-7445 Monday through Friday 8 a.m. to 5 p.m. North Carolina Central University is pleased to announce that National Public Radio’s nationally syndicated talk show Tell Me More is coming to WNCU 90.7 FM for a live broadcast on Friday, March 20, 2009.

North Carolina Central University is pleased to announce that National Public Radio’s nationally syndicated talk show Tell Me More is coming to WNCU 90.7 FM for a live broadcast on Friday, March 20, 2009. Phil Upchurch was born on July 19, 1941, in Chicago, Illinois. A prolific guitarist who is comfortable playing blues, soul, R&B, and jazz, Phil Upchurch has been a prominent figure in Chicago music circles since the mid-’50s. He initially did freelance sessions with such musicians as Jerry Butler, before becoming house guitarist for Chess. Upchurch began playing in R&B backing bands, including those of The Kool Gents, The Dells, and The Spaniels. He eventually formed the Phil Upchurch Combo, and their song, “You Can’t Sit Down,” reached the U.S. Top 30 in 1961 and the UK Top 40 on its reissue five years later. The band included Cornell Muldrow (organ), David Brooks (saxophone), Mac Johnson (trumpet) and Joe Hoddrick (drums). Upchurch had his most successful collaboration with keyboardist Tennyson Stephens in the 1970s.

Phil Upchurch was born on July 19, 1941, in Chicago, Illinois. A prolific guitarist who is comfortable playing blues, soul, R&B, and jazz, Phil Upchurch has been a prominent figure in Chicago music circles since the mid-’50s. He initially did freelance sessions with such musicians as Jerry Butler, before becoming house guitarist for Chess. Upchurch began playing in R&B backing bands, including those of The Kool Gents, The Dells, and The Spaniels. He eventually formed the Phil Upchurch Combo, and their song, “You Can’t Sit Down,” reached the U.S. Top 30 in 1961 and the UK Top 40 on its reissue five years later. The band included Cornell Muldrow (organ), David Brooks (saxophone), Mac Johnson (trumpet) and Joe Hoddrick (drums). Upchurch had his most successful collaboration with keyboardist Tennyson Stephens in the 1970s.

Upchurch did several soul-jazz and funk dates for such labels as Sue and Cadet in the mid- and late ’60s. He signed with Blue Thumb in the ’70s and split his time between sessions with the Crusaders and Ben Sidran and making his own albums. Tommy LiPuma produced Darkness, Darkness and Lovin’ Feelin in 1972 and 1973. Upchurch did one LP for Creed Taylor’s Kudu label in 1975, Upchurch Tennyson, with pianist/vocalist Tennyson Stephens. He returned to studio work, but recorded as a leader for Palladin in 1985, Ichiban in 1991, and Ridgetop in 1995 and 1997.

Upchurch did several soul-jazz and funk dates for such labels as Sue and Cadet in the mid- and late ’60s. He signed with Blue Thumb in the ’70s and split his time between sessions with the Crusaders and Ben Sidran and making his own albums. Tommy LiPuma produced Darkness, Darkness and Lovin’ Feelin in 1972 and 1973. Upchurch did one LP for Creed Taylor’s Kudu label in 1975, Upchurch Tennyson, with pianist/vocalist Tennyson Stephens. He returned to studio work, but recorded as a leader for Palladin in 1985, Ichiban in 1991, and Ridgetop in 1995 and 1997. Now though April 15th

Now though April 15th